How to Qualify for SSDI Benefits With Diabetes (2026 Guide)

Living with diabetes is challenging on its own. When serious complications interfere with your ability to work full-time, the financial strain can quickly become overwhelming. Many people ask the same questions:

- Is diabetes considered a disability by Social Security?

- Can you get SSDI for Type 2 diabetes?

- How hard is it to qualify?

The short answer: yes, you can qualify. But not based on diagnosis alone. The Social Security Administration (SSA) focuses on how diabetes limits your ability to function in a work environment, not whether you have the condition.

This 2026 guide explains current SSA rules, qualifying complications, required evidence, and how to improve your chances of approval.

Understanding SSDI Eligibility for Diabetes

The SSA does not consider diabetes automatically disabling because it is often medically manageable. To qualify for SSDI, your diabetes must cause complications that:

- Have lasted (or are expected to last) at least 12 months, and

- Prevent you from performing Substantial Gainful Activity (SGA).

How the SSA Evaluates Diabetes Claims in 2026

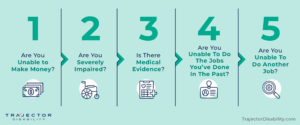

The SSA uses a rigorous 5-step sequential evaluation process to determine if an applicant is disabled.

For 2026, the financial thresholds have increased.

- Are you working at a Substantial Gainful Activity (SGA) level? If your monthly earnings exceed the SGA limit, you are generally considered not disabled, regardless of your medical condition.

- Is your condition severe? Your health problem must be serious enough to greatly limit your ability to do basic work activities, like walking, standing, or lifting.

- Does your condition meet or medically equal a listing in the Blue Book? The SSA maintains a “Listing of Impairments” (often called the “Blue Book”) that describes conditions severe enough to prevent work. Peripheral Artery Disease has its own listing.

- Can you do your past job? If your condition doesn’t meet a listing, the SSA will decide if your health problems keep you from doing any of your old jobs from the last 5 years.

- Can you do any other kind of work? If you can’t do your old job, the SSA will look at your age, education, work experience, and Residual Functional Capacity (RFC) to decide if you can switch to a new type of job.

- To learn more, read our page on SSD Process.

Diabetes Complications That May Qualify for SSDI

Below are the primary “pathways” the SSA uses to approve disability for someone with diabetes:

Neurological Disorders (Section 11.00)

- Diabetic Neuropathy (Listing 11.14): Severe nerve damage that results in an “inability to ambulate effectively” (difficulty walking without a walker/crutches) or “inability to perform fine motor movements” (using your hands for typing, writing, or sorting).

Special Senses / Vision (Section 2.00)

- Diabetic Retinopathy: If your vision in your better eye is 20/200 or worse with correction, or if your visual field is severely restricted, you may qualify under statutory blindness rules.

Genitourinary Disorders (Section 6.00)

- Diabetic Nephropathy (Kidney Disease): This often qualifies if you require regular, ongoing dialysis or have undergone a kidney transplant.

Musculoskeletal Disorders (Section 1.00)

- Amputations: If diabetes-related circulation issues lead to the amputation of a limb (foot, leg, or hand), you may qualify if it prevents you from walking effectively or using your hands for work.

Cardiovascular System (Section 4.00)

- Heart Disease / PAD: Diabetes often leads to coronary artery disease, chronic heart failure, or peripheral artery disease (PAD) that limits your stamina and physical capacity.

Digestive Disorders (Section 5.00)

- Gastroparesis: Severe digestive issues caused by nerve damage can lead to malnutrition, weight loss, and frequent “off-task” time due to nausea and vomiting.

Mental Disorders (Section 12.00)

- Depression and Anxiety: Chronic illness often leads to mental health struggles. The SSA considers the cumulative effect of physical and mental impairments.

Want to win your case? Get the help you need.

Start your FREE CONSULTATION.

How Hard Is It to Get Disability for Diabetes?

It is challenging, but absolutely possible with the proper evidence.

Most diabetes claims are denied because applicants focus on “high blood sugar” instead of “work-related limitations.” The SSA looks for:

- Frequent Hypoglycemia: Episodes that cause confusion or loss of consciousness.

- Fatigue & “Brain Fog”: Extreme exhaustion that prevents you from staying on task.

- Attendance Issues: The need for 3+ days of missed work per month due to symptoms or dialysis.

Type 1 vs. Type 2 Diabetes: Does It Matter?

The SSA does not distinguish between Type 1 and Type 2 diabetes when determining disability.

What matters is severity of complications, not the diagnosis label.

- Type 1 diabetes often involves hypoglycemia or ketoacidosis

- Type 2 diabetes more commonly causes neuropathy, heart disease, or kidney damage

Both can qualify if they prevent sustained work.

Residual Functional Capacity (RFC): The Most Important Factor

If you don’t meet a specific “Listing,” the SSA evaluates your Residual Functional Capacity (RFC)—essentially, what you can still do in a workplace despite your illness. This is how most people with diabetes win their cases.

Does Age Matter? (SSA Grid Rules)

Yes. Significantly.

If you are 50 or older, the SSA uses Medical-Vocational Guidelines (“Grid Rules“) that may favor approval when combined with limited transferable skills.

This is one of the biggest advantages older applicants have.

Common Mistakes That Lead to Denial

- Not following prescribed treatment without justification

- Relying only on primary care records instead of specialists

- Vague symptom descriptions instead of functional limits

- Missing deadlines or SSA requests

How to Strengthen Your SSDI Application for Diabetes

To qualify for SSDI, you’ll need strong medical evidence proving the severity of your diabetes complications. Here’s what to include:

Medical Records: These include documentation of diagnostic tests such as blood sugar logs, HbA1c results, and kidney function tests. Also part of the medical records is your treatment history detailing insulin therapy and medications.

Doctor’s Statements: It is very helpful to have a statement from your physician describing the severity of your complications and how your condition limits your ability to work.

Symptom Journals: A daily log of your symptoms, including blood sugar fluctuations, pain, numbness, or other complications.

Functional Reports: Statements from your employers, coworkers, friends, and/ or family members describing how your condition affects your daily life and ability to work.

Common Mistakes to Avoid

Many applicants make errors that weaken their claims. Here’s how to avoid them:

- Incomplete Medical Records: Ensure your records include all relevant tests, treatments, and doctor’s notes.

- Failing to Follow Treatment Plans: The SSA may deny your claim if you don’t follow prescribed treatments without a valid reason.

- Missing Deadlines: Respond promptly to SSA requests and submit all required documentation on time.

What to Do If Your Claim Is Denied

If your SSDI application is denied, don’t give up. Many applicants succeed on appeal. Trajector Disability can assist you in gathering your documents and navigating the SSDI application and appeal processes. Contact us today for expert guidance and a FREE consultation.

FAQs

Can I qualify for SSDI with type 2 diabetes?

Yes, if your type 2 diabetes causes severe complications that prevent you from working.

What if my diabetes complications aren’t in the Blue Book?

You may still qualify if your condition is medically equivalent to a listed impairment or prevents you from working.

How long does it take to get approved for SSDI with diabetes?

The process typically takes 3 to 5 months, but it can be longer if additional evidence is needed or if you need to appeal.

Can I work while applying for SSDI?

Yes, but your earnings must not exceed the SGA limit ($1,620 per month for non-blind individuals and $2,700 per month for blind individuals in 2025).